5 Key Benefits Of Life Insurance Life Insurance Is A Valuable Benefit To Offer Key Employees.

5 Key Benefits Of Life Insurance . With An Array Of Insurance Plans Available For Our Benefit.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their #2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential in new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

v2[199]-1.png)

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

v2[199]-2.png)

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

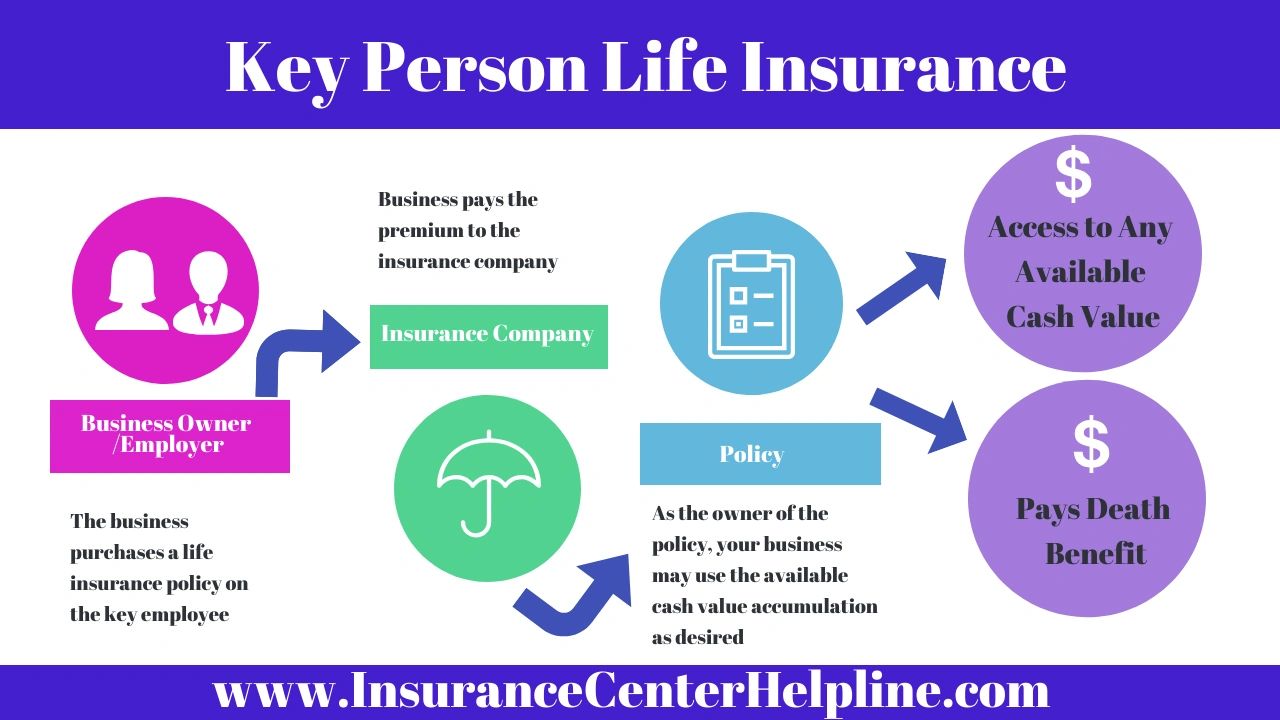

Life insurance is a valuable benefit to offer key employees.

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

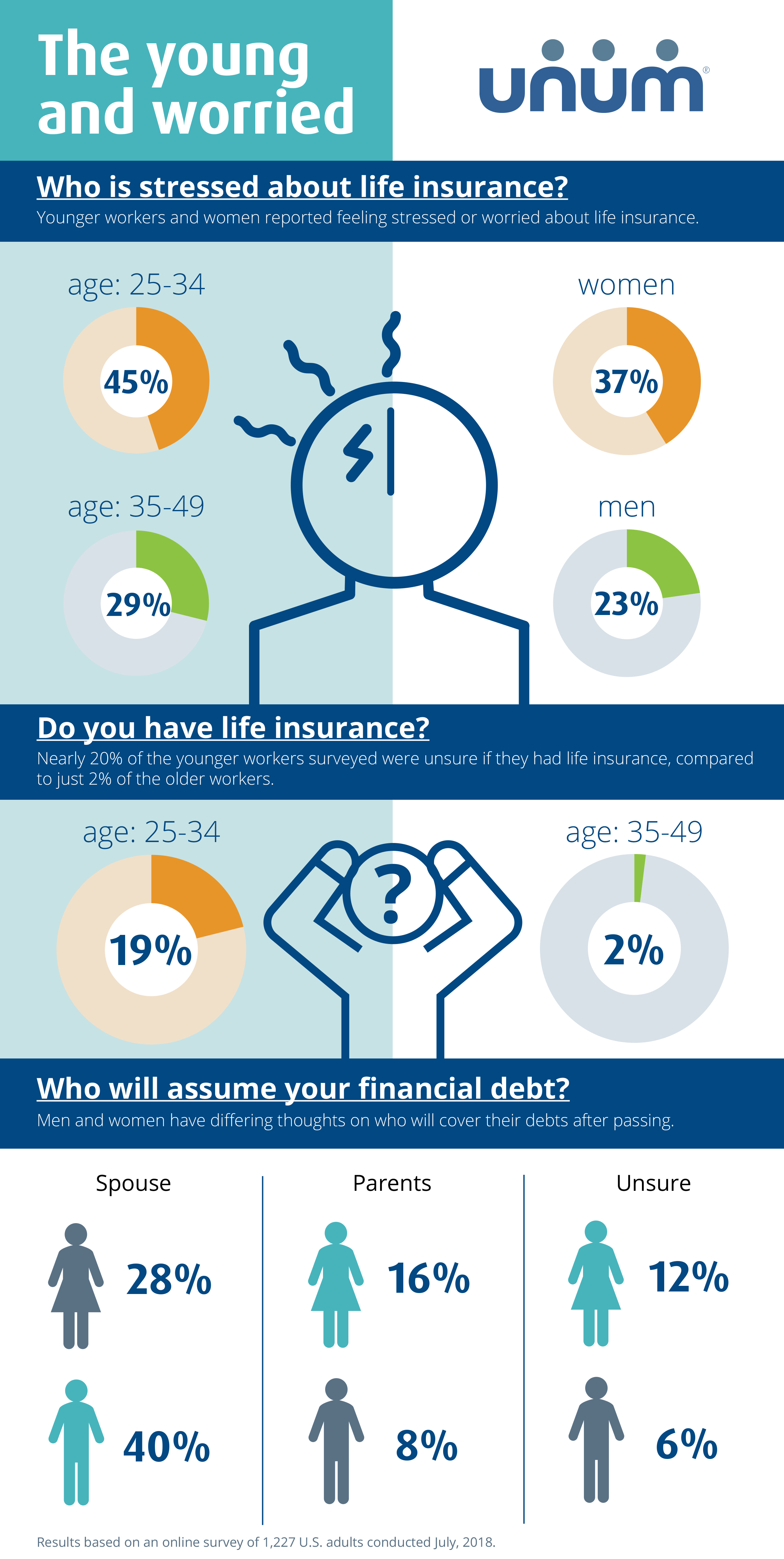

Purchasing life insurance while you're young and healthy is a great way to save money over time and protect your loved ones in the event of your death.

Insurance is term life insurance that has living benefits baked into the policy.

Start studying chapter 5 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

/cloudfront-us-east-1.images.arcpublishing.com/mco/VIYT3RPW5BFVXP2K2D7UKV4QKI.jpg)

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Here, we'll discuss life insurance with living benefits in 2021.

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

These include a $50,000 increase in the annual policy claim limit and the inclusion of treatments for attempted suicide.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Many insurance providers offer cashless claim facility.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Life is full of surprises at every juncture.

Hence, securing it with the best insurance plans is not just pertinent but also requires a thorough analysis of what will suit us, how and why.

Strengthen your benefits package and give employees the protection they want.

Life insurance offers peace of mind, so your employees know their loved ones would be provided for.

Because coverage is also available for their spouse and dependents, life insurance can also help.

The above is the product summary giving the key features of the plan.

This is for illustrative purpose only.

This is for illustrative purpose only. 5 Key Benefits Of Life Insurance . This does not represent a contract.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their #2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential in new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Benefits of universal life insurance.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Life insurance is a valuable benefit to offer key employees.

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're young and healthy is a great way to save money over time and protect your loved ones in the event of your death.

Insurance is term life insurance that has living benefits baked into the policy.

Start studying chapter 5 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Here, we'll discuss life insurance with living benefits in 2021.

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

These include a $50,000 increase in the annual policy claim limit and the inclusion of treatments for attempted suicide.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Many insurance providers offer cashless claim facility.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Life is full of surprises at every juncture.

Hence, securing it with the best insurance plans is not just pertinent but also requires a thorough analysis of what will suit us, how and why.

Strengthen your benefits package and give employees the protection they want.

Life insurance offers peace of mind, so your employees know their loved ones would be provided for.

Because coverage is also available for their spouse and dependents, life insurance can also help.

v2[199]-4.png)

The above is the product summary giving the key features of the plan.

This is for illustrative purpose only.

This is for illustrative purpose only. 5 Key Benefits Of Life Insurance . This does not represent a contract.

Comments

Post a Comment