5 Key Benefits Of Life Insurance A Living Benefit Rider Is Additional Coverage On Your Basic Life Insurance Policy That Provides Supplementary Benefits And Protection To You, Sometimes At An Extra.

5 Key Benefits Of Life Insurance . Guaranteed Benefits1 In The Form Of Lump Sum Or Regular Income To Achieve Your Life Goals Life Insurance Cover4 For Financial Security Of Your Family

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

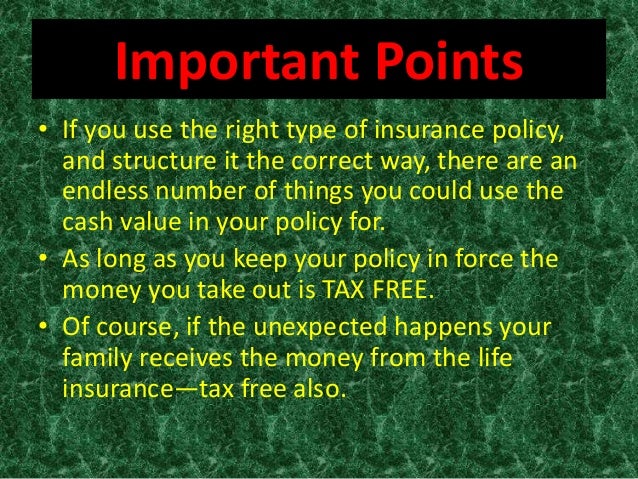

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

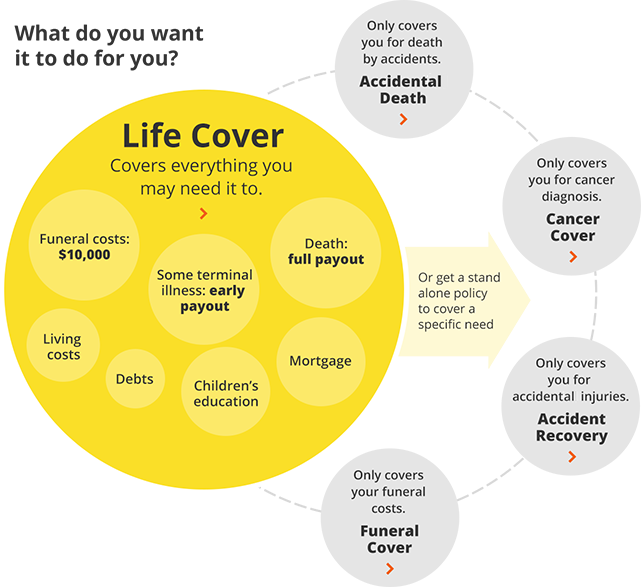

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

The many benefits of having life insurance.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Benefits of life insurance for individuals.

9 benefits of buying life insurance today.

You'll have the peace of mind knowing that your loved ones will have a financial safety net when you're gone.

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

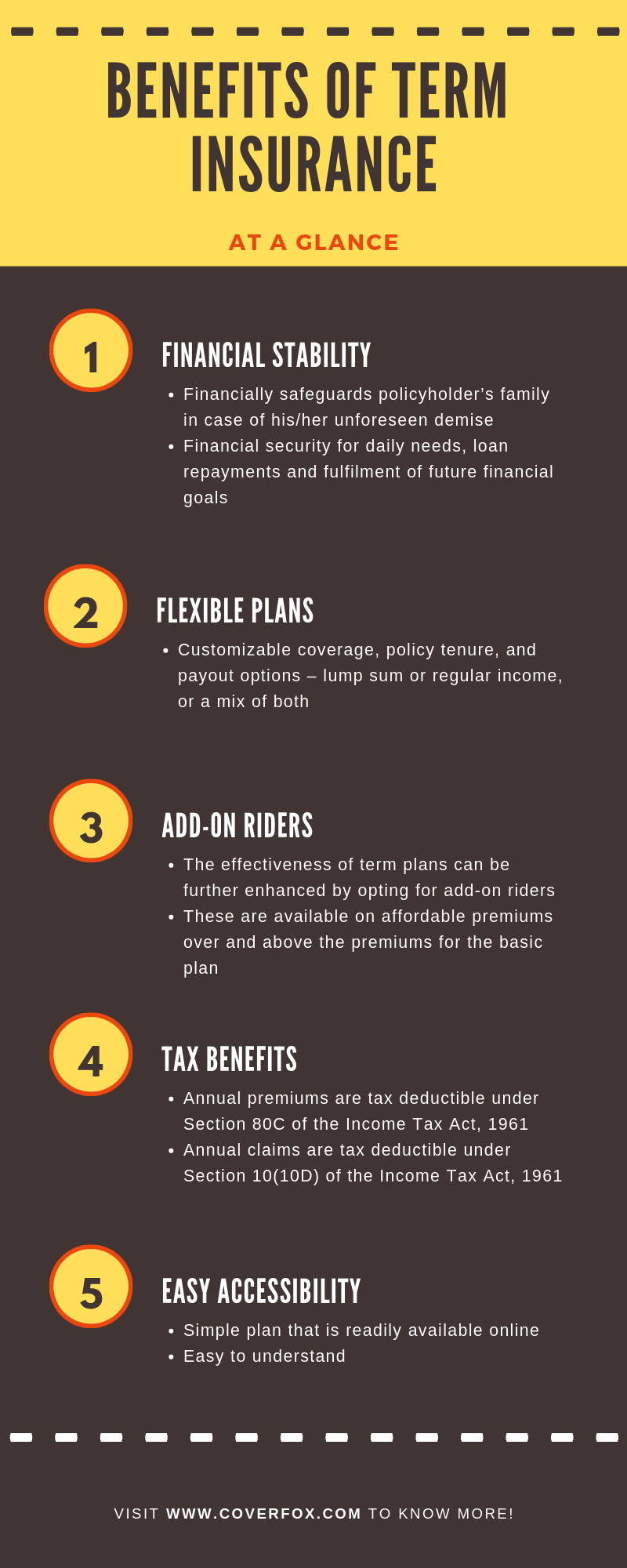

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Here are five key benefits of comprehensive auto coverage.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime.

Life insurance ensures that your family will receive financial support in your absence.

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

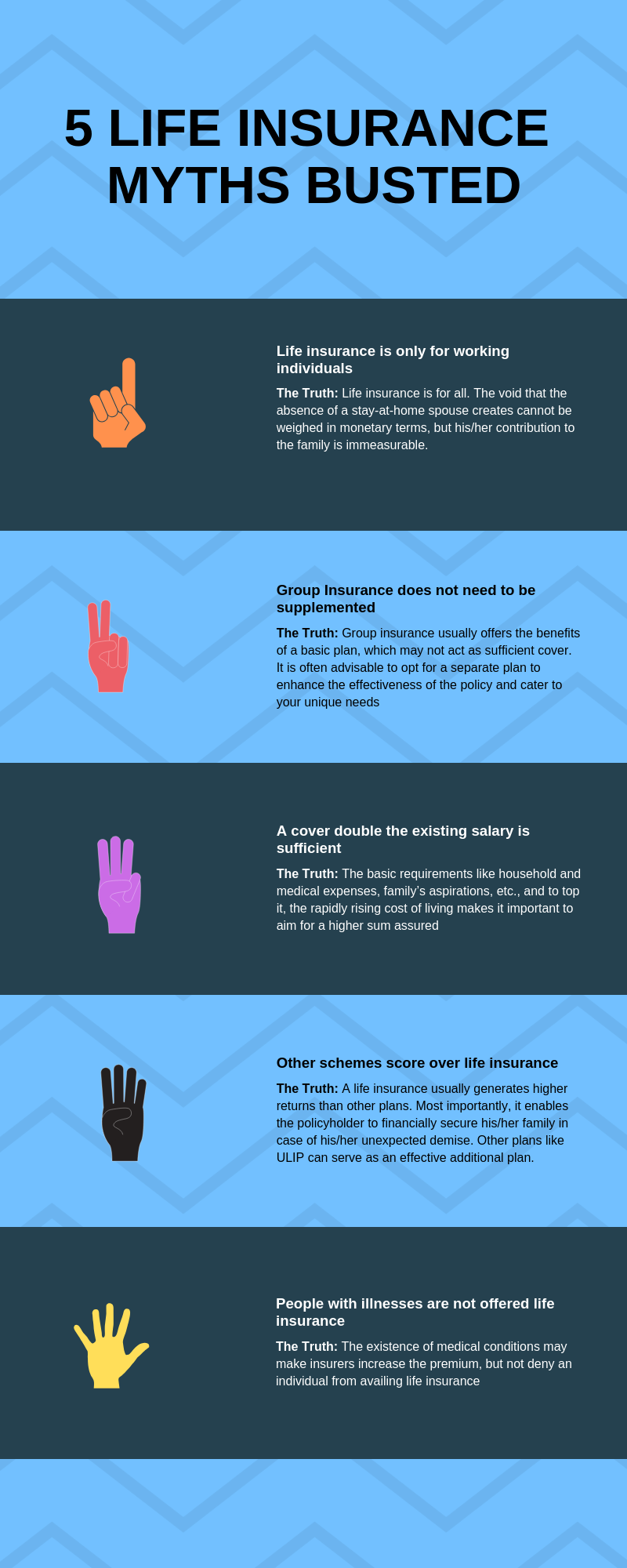

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're young and healthy is a great way to save money over time and protect your loved ones in the event of your death.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Which policy provision will protect the rights of the contingent beneficiary to receive the policy benefits?

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Your life insurance policy offers you dual benefits:

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

Life insurance offers peace of mind, so your employees know their loved ones would be provided for.

Because coverage is also available for their spouse and dependents, life insurance can also help.

These five benefits will inform you of how life would be much simpler if you had an agent.

Many insurance providers offer cashless claim facility.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Find out the term plan tax benefits as well on a.

High sum assured at affordable premium.

Life insurance coverage comes in several different types, says eleni bourgeois, a business blogger at next coursework and writemyx.

Ini Cara Benar Cegah HipersomniaTernyata Madu Atasi InsomniaSegala Penyakit, Rebusan Ciplukan Obatnya5 Khasiat Buah Tin, Sudah Teruji Klinis!!Pentingnya Makan Setelah Olahraga5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTernyata Jangan Sering Mandikan BayiSalah Pilih Sabun, Ini Risikonya!!!Hindari Makanan Dan Minuman Ini Kala Perut KosongLife insurance coverage comes in several different types, says eleni bourgeois, a business blogger at next coursework and writemyx. 5 Key Benefits Of Life Insurance . The death benefit is the primary benefit of a life insurance policy, because this benefit will pay to your beneficiary, should you pass away while insured.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

The many benefits of having life insurance.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Benefits of life insurance for individuals.

9 benefits of buying life insurance today.

You'll have the peace of mind knowing that your loved ones will have a financial safety net when you're gone.

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

Know the top 8 advantages of life insurance.

Compare and buy 1 cr life cover at rs.

Investing in life insurance gives you and your family a secure future.

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Here are five key benefits of comprehensive auto coverage.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime.

![5 Key Benefits of Live Org Charts [2020] | Organimi](https://www.organimi.com/wp-content/uploads/2020/11/org-chart-featured-2.png)

Life insurance ensures that your family will receive financial support in your absence.

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Purchasing life insurance while you're young and healthy is a great way to save money over time and protect your loved ones in the event of your death.

They are both involved in an automobile accident where pat dies instantly and karen dies 5 days later.

Which policy provision will protect the rights of the contingent beneficiary to receive the policy benefits?

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Your life insurance policy offers you dual benefits:

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

Life insurance offers peace of mind, so your employees know their loved ones would be provided for.

Because coverage is also available for their spouse and dependents, life insurance can also help.

These five benefits will inform you of how life would be much simpler if you had an agent.

Many insurance providers offer cashless claim facility.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Find out the term plan tax benefits as well on a.

High sum assured at affordable premium.

Life insurance coverage comes in several different types, says eleni bourgeois, a business blogger at next coursework and writemyx.

Life insurance coverage comes in several different types, says eleni bourgeois, a business blogger at next coursework and writemyx. 5 Key Benefits Of Life Insurance . The death benefit is the primary benefit of a life insurance policy, because this benefit will pay to your beneficiary, should you pass away while insured.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Kue Apem Bukan Kue Asli IndonesiaResep Cumi Goreng Tepung MantulTernyata Bayam Adalah Sahabat WanitaKhao Neeo, Ketan Mangga Ala ThailandBir Pletok, Bir Halal BetawiPete, Obat Alternatif Diabetes5 Makanan Pencegah Gangguan PendengaranTernyata Jajanan Pasar Ini Punya Arti RomantisNikmat Kulit Ayam, Bikin Sengsara

Comments

Post a Comment