5 Key Benefits Of Life Insurance Reduced Death Benefit Prepayment (the Primary Feature Of A Viatical Settlement Is The Prepayment Of.

5 Key Benefits Of Life Insurance . Insurance Is Term Life Insurance That Has Living Benefits Baked Into The Policy.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their #2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Here's a handy guide of definitions to help.

Face value or face amount:

A life insurance policy's face value is typically the amount of death benefit it will pay when the insured dies.

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

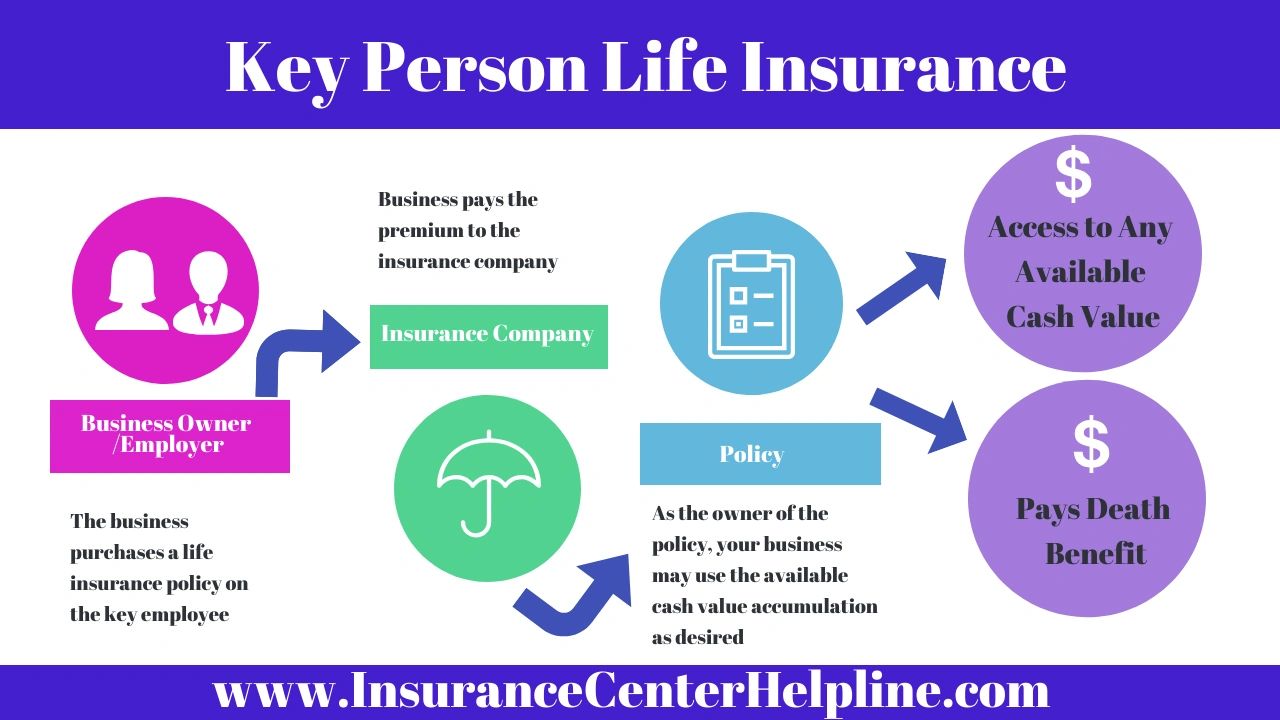

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Life insurance is a valuable benefit to offer key employees.

Life insurance ensures that your family will receive financial support in your absence.

These include a $50,000 increase in the annual policy claim limit and the inclusion of treatments for attempted suicide.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

v2[199]-1.png)

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

v2[199]-2.png)

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Start studying chapter 5 life insurance.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Insurance is term life insurance that has living benefits baked into the policy.

Policyholders with qualifying chronic, critical, and terminal illnesses or conditions may be able to advance the payment of their policy's death benefit, which can help to cover the costs of medical.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

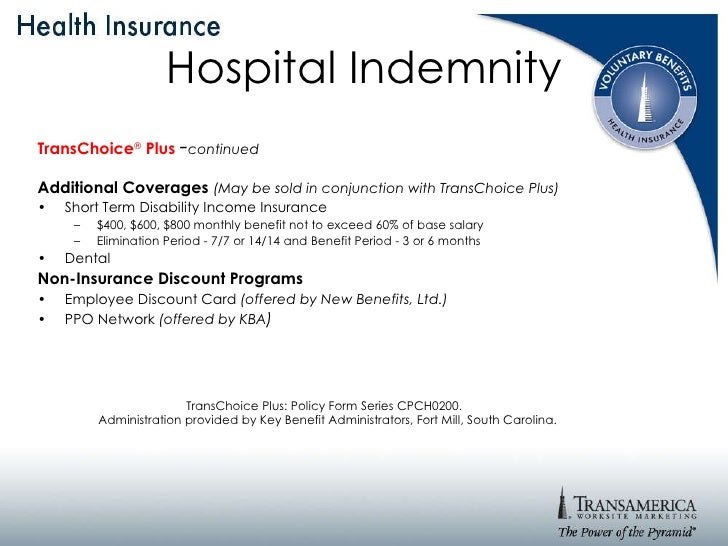

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

High sum assured at affordable premium.

These five benefits will inform you of how life would be much simpler if you had an agent.

Insurance regulatory & development authority (irda) requires all life insurance supplementary/extra benefits :

These are the optional benefits that can be added to your basic note :the above is the product summary giving the key features of the plan.

Cara Baca Tanggal Kadaluarsa Produk MakananMengusir Komedo Membandel - Bagian 2Saatnya Minum Teh Daun Mint!!Segala Penyakit, Rebusan Ciplukan ObatnyaTernyata Madu Atasi InsomniaSaatnya Bersih-Bersih UsusPD Hancur Gegara Bau Badan, Ini Solusinya!!Fakta Salah Kafein KopiObat Hebat, Si Sisik NagaMengusir Komedo MembandelDiscover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan. 5 Key Benefits Of Life Insurance . Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

A life insurance policy provides several benefits, depending on the type of product purchased.

Broadly speaking, a life insurance plan provides life protection along with the maturity proceeds (except in the case of pure term plans).

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

Benefits of life insurance for individuals.

#1 — a key reason to purchase life insurance is to provide immediate cash to help the survivors pay their #2 — other advantages of life insurance proceeds can include the funding of future education expenses for the insured's children or grandchildren.

How can i find affordable insurance?

Payouts are generally tax free, so your beneficiaries won't need to cough up extra money.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Here's a handy guide of definitions to help.

Face value or face amount:

A life insurance policy's face value is typically the amount of death benefit it will pay when the insured dies.

/cloudfront-us-east-1.images.arcpublishing.com/mco/VIYT3RPW5BFVXP2K2D7UKV4QKI.jpg)

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Life insurance is a valuable benefit to offer key employees.

Life insurance ensures that your family will receive financial support in your absence.

These include a $50,000 increase in the annual policy claim limit and the inclusion of treatments for attempted suicide.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

![Comprehensive AARP Life Insurance Review [2020 Update]](https://2zncgd19p5j13o7wjrpxbajs-wpengine.netdna-ssl.com/wp-content/uploads/2018/01/AARP-no-physical-overview.png)

Here, we'll discuss life insurance with living benefits in 2021.

Fortunately, there is a solution!

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Start studying chapter 5 life insurance.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Insurance is term life insurance that has living benefits baked into the policy.

Policyholders with qualifying chronic, critical, and terminal illnesses or conditions may be able to advance the payment of their policy's death benefit, which can help to cover the costs of medical.

Life insurance policy provides tax benefits to the insured person, as per section 80c of the income tax act.

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

High sum assured at affordable premium.

These five benefits will inform you of how life would be much simpler if you had an agent.

Insurance regulatory & development authority (irda) requires all life insurance supplementary/extra benefits :

These are the optional benefits that can be added to your basic note :the above is the product summary giving the key features of the plan.

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan. 5 Key Benefits Of Life Insurance . Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.Khao Neeo, Ketan Mangga Ala ThailandResep Cumi Goreng Tepung MantulResep Garlic Bread Ala CeritaKuliner Ternyata Bayam Adalah Sahabat WanitaIkan Tongkol Bikin Gatal? Ini Penjelasannya9 Jenis-Jenis Kurma TerfavoritSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat5 Trik Matangkan ManggaBir Pletok, Bir Halal Betawi

Comments

Post a Comment