5 Key Benefits Of Life Insurance Life Insurance Is A Valuable Benefit To Offer Key Employees.

5 Key Benefits Of Life Insurance . Life Insurance Is Issued By The Prudential Insurance Company Of America, Pruco Life Insurance Company (except In Ny And/or Nj), And Pruco Life.

SELAMAT MEMBACA!

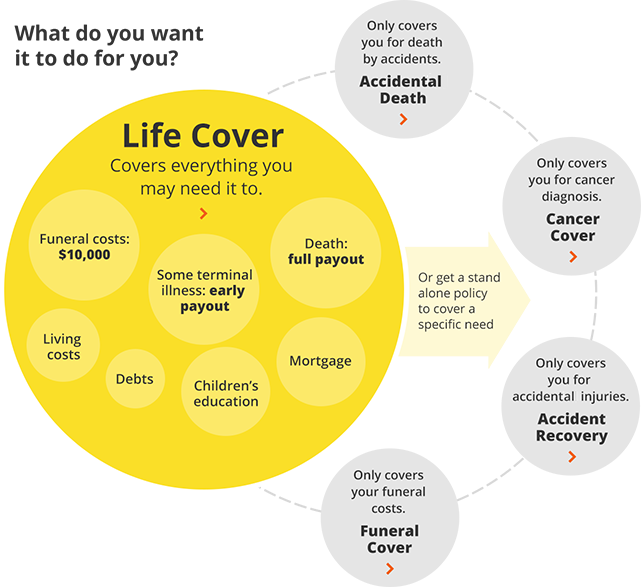

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

The many benefits of having life insurance.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

Certain key parameters that you should watch out for while evaluating the best term insurance are:

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

9 benefits of buying life insurance today.

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

His musings can be found.

Key man life insurance is highly recommended to help the company survive the hardship of losing a key employee.

Many sole proprietors can also utilize the benefits of life insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

Here are five key benefits of comprehensive auto coverage.

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

You will want to make sure that the death benefit you select is large enough to cover your family's living expenses after your gone, such as the key to making sure your life insurance policy benefits you the most is to first and foremost, find.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

Term life insurance policies are still a great option with many advantages.

Although term insurance is not always the most effective type of life insurance for all of a client's death benefit needs, it can still be useful in many circumstances.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Benefits of whole life insurance policy:

Start studying chapter 5 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Find out the term plan tax benefits as well on a.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Strengthen your benefits package and give employees the protection they want.

Because coverage is also available for their spouse and dependents, life insurance can also help.

Introduction insurance regulatory & development authority (irda) requires all life insurance companies operating in india to provide note:

The above is the product summary giving the key features of the plan.

This does not represent a contract.

Your life insurance policy offers you dual benefits:

Comprehensive financial protection against unforeseen events for your family.

A keyman policy will remain keyman policy even after assignment of the policy.

We have the life insurance 101 lesson you've been looking for.

Ternyata Tidur Bisa Buat KankerJam Piket Organ Tubuh (Hati)Cara Benar Memasak SayuranWajah Mulus Dengan Belimbing WuluhObat Hebat, Si Sisik NagaIni Cara Benar Hapus Noda Bekas JerawatTernyata Einstein Sering Lupa Kunci MotorTernyata Tahan Kentut Bikin KeracunanMana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Mulai Sekarang, Minum Kopi Tanpa Gula!!The most simple explanation of life insurance you here's the life insurance 101 you've been looking for! 5 Key Benefits Of Life Insurance . We'll answer the most basic questions in the the death benefit is usually a level amount, meaning it won't increase over time.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

The many benefits of having life insurance.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

Certain key parameters that you should watch out for while evaluating the best term insurance are:

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance is often perceived as a coverage that's only needed if you have children or at least married.

9 benefits of buying life insurance today.

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

His musings can be found.

Key man life insurance is highly recommended to help the company survive the hardship of losing a key employee.

Many sole proprietors can also utilize the benefits of life insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

Here are five key benefits of comprehensive auto coverage.

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

You will want to make sure that the death benefit you select is large enough to cover your family's living expenses after your gone, such as the key to making sure your life insurance policy benefits you the most is to first and foremost, find.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

Term life insurance policies are still a great option with many advantages.

Although term insurance is not always the most effective type of life insurance for all of a client's death benefit needs, it can still be useful in many circumstances.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Benefits of whole life insurance policy:

Start studying chapter 5 life insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Find out the term plan tax benefits as well on a.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Strengthen your benefits package and give employees the protection they want.

Because coverage is also available for their spouse and dependents, life insurance can also help.

Introduction insurance regulatory & development authority (irda) requires all life insurance companies operating in india to provide note:

The above is the product summary giving the key features of the plan.

This does not represent a contract.

Your life insurance policy offers you dual benefits:

Comprehensive financial protection against unforeseen events for your family.

A keyman policy will remain keyman policy even after assignment of the policy.

We have the life insurance 101 lesson you've been looking for.

The most simple explanation of life insurance you here's the life insurance 101 you've been looking for! 5 Key Benefits Of Life Insurance . We'll answer the most basic questions in the the death benefit is usually a level amount, meaning it won't increase over time.Petis, Awalnya Adalah Upeti Untuk RajaSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatTrik Menghilangkan Duri Ikan BandengCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Stawberry Cheese Thumbprint CookiesPecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Ponzu, Cocolan Ala JepangIni Beda Asinan Betawi & Asinan BogorResep Beef Teriyaki Ala CeritaKulinerResep Selai Nanas Homemade

Comments

Post a Comment