5 Key Benefits Of Life Insurance Tax Benefits On Life Insurance:

5 Key Benefits Of Life Insurance . Richard Laycock Is Finder's Insights Editor After Spending The Last Five Years Writing And Editing Articles About Insurance.

SELAMAT MEMBACA!

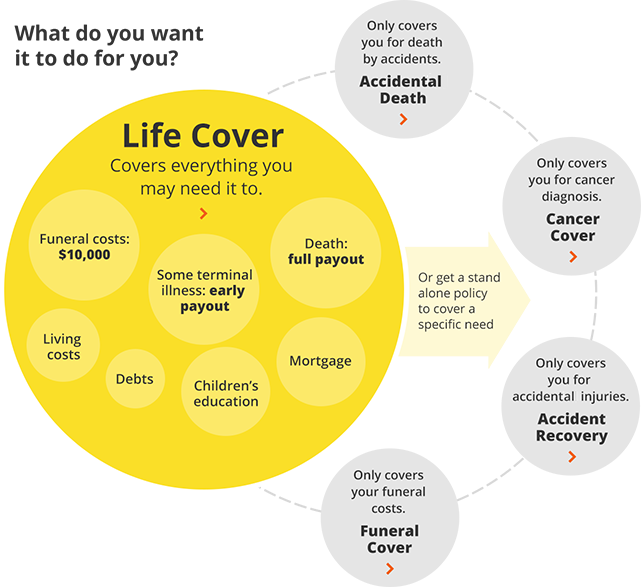

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

This is a ratio of.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Whole life insurance is also famous for its tax benefits.

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

Benefits of universal life insurance.

How can i find affordable insurance?

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

His musings can be found across the web.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

But what are life insurance living benefits?

This article explains what they are and how they work.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Start studying chapter 5 life insurance.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Following are the 3 primary benefits of life insurance policy:

Life is unpredictable and can be full of uncertainties.

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

Business owners may need two types of life insurance policies:

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

—� insurance that provides compensation to your beneficiaries should you die prematurely.

ς� this is a 10 key questions (continued) 2.

How does life insurance work?

Introduction insurance regulatory & development authority (irda) requires all life insurance companies operating in india to provide note:

The above is the product summary giving the key features of the plan.

This is for illustrative purpose only.

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Awas, Bibit Kanker Ada Di Mobil!!Ternyata Cewek Curhat Artinya SayangMulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurMengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!Hindari Makanan Dan Minuman Ini Kala Perut Kosong4 Titik Akupresur Agar Tidurmu Nyenyak5 Manfaat Meredam Kaki Di Air EsTernyata Kalsium Tidak Selalu Baik Untuk TubuhThese five benefits will inform you of how life would be much simpler if you had an agent. 5 Key Benefits Of Life Insurance . Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

This is a ratio of.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Whole life insurance is also famous for its tax benefits.

The many benefits of having life insurance.

If you're like most people, you understand the main purpose of life insurance — to provide a payment to your loved ones when you die.

Life insurance benefits can help replace your income if you pass away.

Life insurance also offered and issued by third.

Benefits of universal life insurance.

How can i find affordable insurance?

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

His musings can be found across the web.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

It pays to replace your car if it's stolen.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Life insurance offers benefits while you are still living and the main reason to have life insurance is for the death benefit and living benefit rider.

Life insurance is a valuable benefit to offer key employees.

Use a life policy as part of your executive compensation package.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

But what are life insurance living benefits?

This article explains what they are and how they work.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

Life insurance can even be used to help fund a child's education.

It's a key benefit to help you attract and keep quality employees.

The insurance benefits guide contains an abbreviated description of insurance benefits provided by or through the south carolina public employee benefit authority.

The plan of benefits documents and benefits contracts contain complete descriptions of the health and dental plans and all other.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Each life insurance living benefits company has guidelines regarding the specific requirements of the rider.

The chart below shows some of these guidelines and with these benefits, the life insurance company pays or advances a portion of the policy's death benefit to you to pay for care or treatment.

Start studying chapter 5 life insurance.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Life is full of surprises at every juncture.

With an array of insurance plans available for our benefit.

Following are the 3 primary benefits of life insurance policy:

Life is unpredictable and can be full of uncertainties.

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

Business owners may need two types of life insurance policies:

Discover the benefits of life insurance and why you should consider establishing a policy for your peace of mind, from iott insurance in michigan.

Like any other insurance, life insurance is a contract between you and a provider to guarantee a payment after an unfortunate loss of life.

—� insurance that provides compensation to your beneficiaries should you die prematurely.

ς� this is a 10 key questions (continued) 2.

How does life insurance work?

Introduction insurance regulatory & development authority (irda) requires all life insurance companies operating in india to provide note:

The above is the product summary giving the key features of the plan.

This is for illustrative purpose only.

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

These five benefits will inform you of how life would be much simpler if you had an agent. 5 Key Benefits Of Life Insurance . Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.Ayam Goreng Kalasan Favorit Bung KarnoSejarah Nasi Megono Jadi Nasi Tentara3 Jenis Daging Bahan Bakso TerbaikResep Stawberry Cheese Thumbprint CookiesResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatCegah Alot, Ini Cara Benar Olah Cumi-Cumi5 Makanan Pencegah Gangguan PendengaranJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaJangan Ngaku Penggemar Burger Kalau Tak Tahu Sejarah Ditemukannya Hamburger

Comments

Post a Comment