5 Key Benefits Of Life Insurance A Life Insurance Death Benefit Could Provide Financial Safety For Your Family, Business Partner And/or Buying A Key Person Life Insurance Policy Can Be Very Helpful By Making Sure The Company Survives This Is Done By Setting Aside A Portion Of Life Insurance Proceeds For What Is Owed On The Bank Loan.

5 Key Benefits Of Life Insurance . I Can Help With Questions About Auto, Homeowners And Life Insurance.

SELAMAT MEMBACA!

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

This is a ratio of.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Whole life insurance is also famous for its tax benefits.

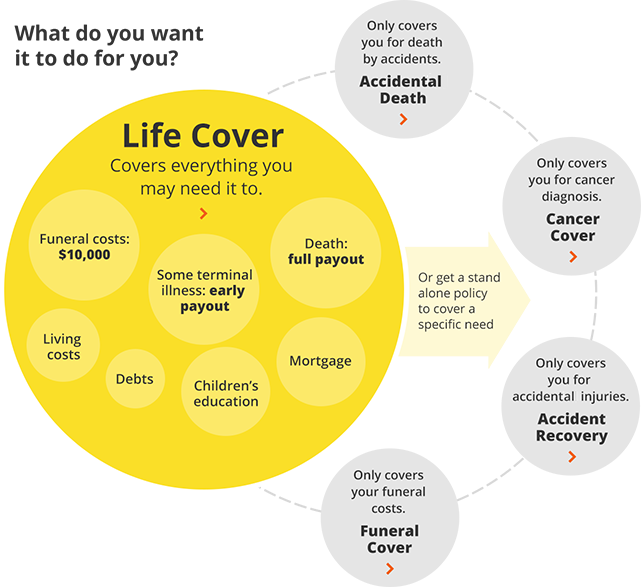

The benefit of a life insurance policy is that it can mitigate a lack of savings after you die, whether that be to help cover the cost of so far we've looked at the general benefits of most life insurance policies;

In the next section we'll drill down into the types of policies and their specific advantages.

The many benefits of having life insurance.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential in new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third.

How can i find affordable insurance?

Are there any benefits to adding riders to my policy?

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Fortunately, there is a solution!

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

Here are five key benefits of comprehensive auto coverage.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Tax benefits on life insurance:

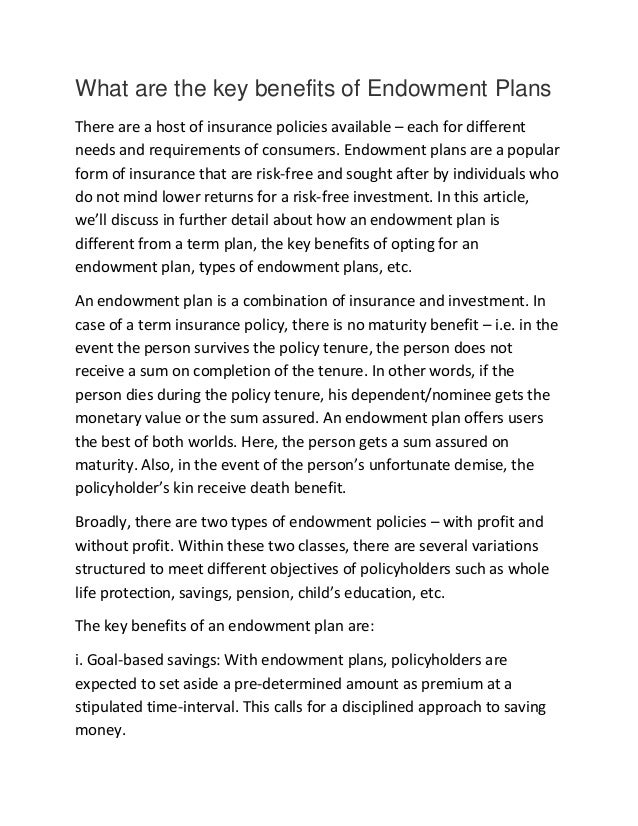

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

When you explain key life insurance terms, your clients' knowledge and confidence will increase.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

In this review, we will cover 5 key facts about aig's indexed universal life insurance policy to determine if this form of coverage is right for you.

Life insurance is a valuable benefit to offer key employees.

Life insurance is issued by the prudential insurance company of america, pruco life insurance company (except in ny and/or nj), and pruco life.

Life is full of surprises at every juncture.

Hence, securing it with the best insurance plans is not just pertinent but also requires a thorough analysis of what will suit us, how and why.

When you're looking to get coverage, there are several different factors.

A life insurance death benefit could provide financial safety for your family, business partner and/or buying a key person life insurance policy can be very helpful by making sure the company survives this is done by setting aside a portion of life insurance proceeds for what is owed on the bank loan.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

High sum assured at affordable premium.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Canada protection plan's no medical & simplified life insurance benefits provide members with competitive scholarships, emergency grants, orphan scholarships and more!

The insurance company as well as travel agencies also provides the coverage while you are on travel for either longer time or for the shorter travel plan.

The travel insurance companies offer maximum coverage to the insured person to gives more benefits incase of accident or any types of illness.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

—� insurance that provides compensation to your beneficiaries should you die prematurely.

ς� this is a 10 key questions (continued) 2.

How does life insurance work?

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Jam Piket Organ Tubuh (Ginjal)Ini Manfaat Seledri Bagi KesehatanPentingnya Makan Setelah OlahragaTernyata Cewek Curhat Artinya SayangSegala Penyakit, Rebusan Ciplukan ObatnyaUban, Lawan Dengan Kulit Kentang5 Manfaat Habbatussauda Untuk Pria Dan Wanita, Yang Terakhir Wajib DibacaManfaat Kunyah Makanan 33 KaliPepaya Muda Dan Air Kelapa, Obat Manjur Asam UratTernyata Inilah Makanan Meningkatkan Gairah Seksual Dengan DrastisThese five benefits will inform you of how life would be much simpler if you had an agent. 5 Key Benefits Of Life Insurance . Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

Life insurance can be essential for protecting your family in the event of a tragedy.

Life insurance payouts aren't considered income for tax purposes, and your beneficiaries don't have to report the money when they file their tax returns.

Life insurance also offers tax benefits.

The premium you pay on your policy is eligible for tax exemption under section 80c of the income tax act.

This is a ratio of.

Universal life insurance benefits, for instance, change over time depending on premium payments and personal choices made by the policyholder.

Whole life insurance is also famous for its tax benefits.

The benefit of a life insurance policy is that it can mitigate a lack of savings after you die, whether that be to help cover the cost of so far we've looked at the general benefits of most life insurance policies;

In the next section we'll drill down into the types of policies and their specific advantages.

The many benefits of having life insurance.

Life insurance benefits can help replace your income if you pass away.

This means your beneficiaries could use the money to help cover essential in new york, life insurance issued through allstate life insurance company of new york, hauppauge ny.

Life insurance also offered and issued by third.

How can i find affordable insurance?

Are there any benefits to adding riders to my policy?

Richard laycock is finder's insights editor after spending the last five years writing and editing articles about insurance.

Guaranteed benefits1 in the form of lump sum or regular income to achieve your life goals life insurance cover4 for financial security of your family

Term life insurance is a great short term option to replace lost income or to cover a mortgage.

It even has a few benefits as key person life insurance if a because cash value life insurance offers minimal benefits when held in an ilit, a term life policy may have some value for this limited strategy.

Fortunately, there is a solution!

Living benefits that can be added to a term life depending on the policy you select, the insurance company can advance this benefit if the insured is diagnosed with a terminal illness, critical illness.

Here are five key benefits of comprehensive auto coverage.

Could you afford to buy another car like the one you i'm currently an insurance editor at nerdwallet, a personal finance site.

I can help with questions about auto, homeowners and life insurance.

Tax benefits on life insurance:

The endowment life insurance plan has all benefits of a term insurance plan.

However, there's one thing that differentiates the two.

When you explain key life insurance terms, your clients' knowledge and confidence will increase.

The key benefits of life insurance life insurance payouts can help provide financial security for loved ones all of these life insurance benefits might get you thinking about whether or not a policy could.

In this review, we will cover 5 key facts about aig's indexed universal life insurance policy to determine if this form of coverage is right for you.

Life insurance is a valuable benefit to offer key employees.

Life insurance is issued by the prudential insurance company of america, pruco life insurance company (except in ny and/or nj), and pruco life.

Life is full of surprises at every juncture.

Hence, securing it with the best insurance plans is not just pertinent but also requires a thorough analysis of what will suit us, how and why.

When you're looking to get coverage, there are several different factors.

A life insurance death benefit could provide financial safety for your family, business partner and/or buying a key person life insurance policy can be very helpful by making sure the company survives this is done by setting aside a portion of life insurance proceeds for what is owed on the bank loan.

Check term insurance benefits and protect your family by providing financial stability in case of early demise.

Following are the primary benefits of term life insurance that you can avail by buying term insurance:

High sum assured at affordable premium.

Almost everyone can benefit from buying a life insurance policy, regardless of the myths you've heard.

Canada protection plan's no medical & simplified life insurance benefits provide members with competitive scholarships, emergency grants, orphan scholarships and more!

The insurance company as well as travel agencies also provides the coverage while you are on travel for either longer time or for the shorter travel plan.

The travel insurance companies offer maximum coverage to the insured person to gives more benefits incase of accident or any types of illness.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Terms in this set (19).

Reduced death benefit prepayment (the primary feature of a viatical settlement is the prepayment of.

Comprehensive financial protection against unforeseen events for your family.

Proceeds of key man insurance is taxable.

A keyman policy will remain keyman policy even after assignment of the policy.

—� insurance that provides compensation to your beneficiaries should you die prematurely.

ς� this is a 10 key questions (continued) 2.

How does life insurance work?

These five benefits will inform you of how life would be much simpler if you had an agent.

Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.

These five benefits will inform you of how life would be much simpler if you had an agent. 5 Key Benefits Of Life Insurance . Independent insurance brokers however, can provide you with products from almost any insurance carrier on the marketplace based on your price and coverage preferences.Plesir Ke Madura, Sedot Kelezatan Kaldu Kokot MaduraFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarKhao Neeo, Ketan Mangga Ala ThailandJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaSejarah Kedelai Menjadi TahuJangan Ngaku Penggemar Burger Kalau Tak Tahu Sejarah Ditemukannya HamburgerWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Ternyata Makanan Ini Hasil NaturalisasiTernyata Asal Mula Soto Bukan Menggunakan DagingResep Beef Teriyaki Ala CeritaKuliner

Comments

Post a Comment